Excitement About Invoice Factoring

Table of ContentsInvoice Factoring Things To Know Before You Get ThisNot known Details About Invoice Factoring 7 Simple Techniques For Invoice Factoring

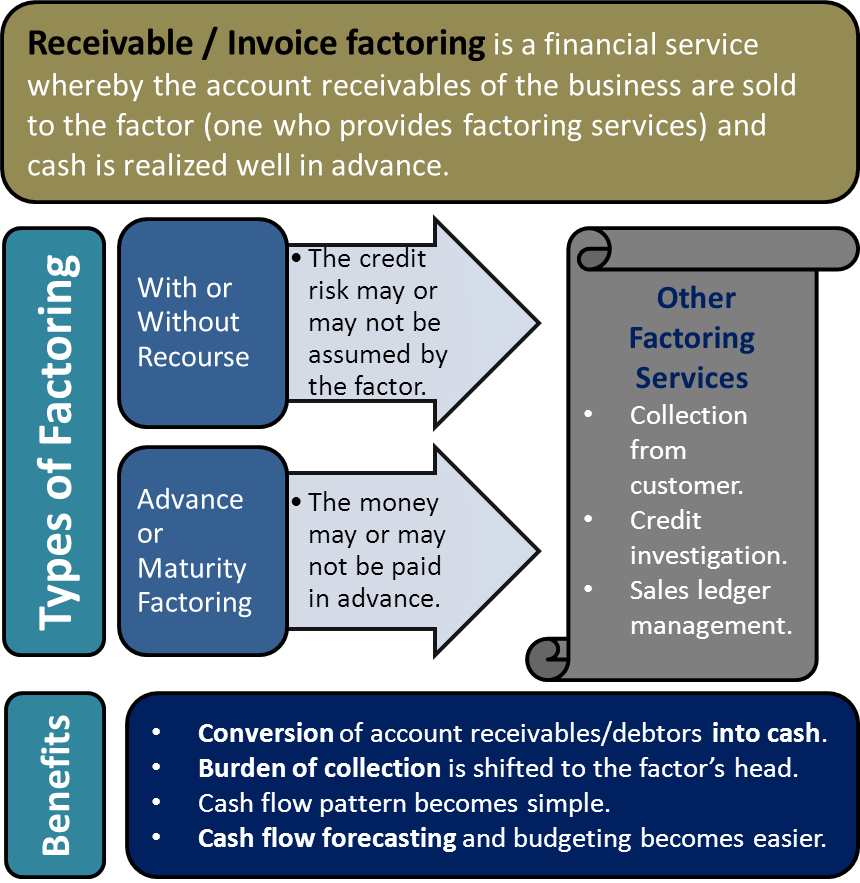

The first instalment the factoring development covers regarding 80% of the receivable (this amount varies). The staying 20%, much less the factoring cost, is rebated as quickly as your customer pays the billing completely. Here are the steps: You send the invoices for purchasingThe factoring firm sends you the advance (e.g., 80% of the invoice) Your customer pays 30 to 120 days laterThe factoring business sends you the refund (e.g., 20%, much less the fee) Recap Whilst the particular proportion can vary, it's normally performed in two phases.Billing financing is the common terms for the entire accounts- receivable financing industry. Factoring and also discounting are consequently kinds of asset-based financing, covered by the umbrella term 'billing financing' and also they both share usual principles. The vital distinction between billing factoring and discounting is that while invoice discounting permits the service to keep control of its sales ledger and also invoice collection, factoring gives the billing finance company that duty.

Some businesses may be concerned concerning the factor taking over the debt control for their business ledger, as a result of the connections with their clients as well as customers. Some factoring companies will certainly have really little contact with your debtors and also can in some instances, supply a solution to establish up a different savings account which they presume control of, as well as that is under your business name.

5 Easy Facts About Invoice Factoring Described

Choice factoring is typical method, unless or else specified, suggesting if your consumer doesn't pay it becomes your obligation to cover the expense. Non-recourse factoring is a specific item in it's very own right and is commonly referred to by loan providers as 'uncollectable bill security'. Poor financial obligation protection secures your service from non-payment.

The billing finance market is not currently controlled by the Financial Conduct Authority (FCA). With this in mind you require to work out due persistance with any company you may choose, exploring the opportunity of hidden charges which may not be quickly obvious. It's worth mentioning that guideline, should it develop in the future, would certainly probably enhance the expenses of factoring (invoice factoring).

We have several choices to look for factoring services, whether you are looking my blog to factor your business' billings selectively, or you require a factoring center to gain access to funds, ongoing. If you think your service may gain from a billing funding please do not hesitate to either use our free invoice financing system (below) that provides you access to the entire market, submit the quick quote kind towards the top of this page, or simply send us an e-mail.

Some Of Invoice Factoring

Learn more information regarding exactly how factoring jobs on business Specialist website. Many of the popular banks do provide factoring although some are exceptionally mindful concerning taking on customers outside of their existing company clients. Use Service Expert's free quote service to obtain quotes from a range of the top lenders.

Invoice factoring is a means for services to increase cash by selling billings to a factoring company at a discount rate. Factoring generally consists of debt control services, and aids business release money from their debtor book. Right here's every little thing visit their website you require to understand about invoice factoring. Invoice factoring is a kind of invoice financing, created for organizations that invoice their customers and also receive repayment on terms.

Joe's Company needs aid with capital and agrees to a factoring center with a lending institution. The breakthrough portion in Joe's contract with The Billing Company is 80%, so when Joe raises an invoice worth 10,000 as well as posts it online, The Invoice Business advances Joe 8,000. invoice factoring. As we have actually discussed, one prospective benefit of factoring is debt control, so if the consumer was late paying what they owed Joe, The Invoice Company would certainly call them on his part and advise them the bill was overdue.